As we published the MCEX Market Accepted Protocol (MAP) today, I wanted to take this opportunity to share with you what the MAP is all about and what we hope to achieve with it.

Our mission at Micro Connect is to connect global capital with China’s micro and small businesses. Despite being a vibrant segment and one of the largest contributors to the nation’s GDP, micro and small businesses have long struggled to meet their funding needs and global investors have not been able to access such investments. The significant disconnect between micro and small businesses and the mainstream financial markets has been a key hindrance to the long-term sustainable growth of the Chinese economy.

The progress China has made in digitizing its economy has laid a solid foundation for bridging this large divide, and we have now pioneered a new asset class, Daily Revenue Contract (DRC), that can connect global institutional capital with micro and small businesses. Given the novel nature of this investment model, we had to first blaze a trail for other investors.

Starting with our proprietary capital and followed by ongoing inflows from external investors, we launched Micro Connect Leadership Fund (MCLF) in early 2022. MCLF has made investments in more than 10,000 micro and small businesses so far, showcasing how investable this market could be. While we have successfully completed “proof of concept” for the investment model with MCLF, our ultimate goal is to build a new financial market where micro and small businesses can access institutional capital at scale. This was why we launched Micro Connect Macao Financial Assets Exchange (MCEX) in August 2023, which kicked off the market-operator phase of our journey.

Our MAP released today represents a culmination of our experience, insights, and lessons learned since we began our journey. We also wanted to take the market’s feedback on the construct and application of the MAP, which will serve as a guide for all stakeholders as they participate in our new financial ecosystem.

While the MAP contains comprehensive details on standards, principles, and guidelines for future market participants, its intellectual objective is to provide perspectives and insights with respect to the following questions:

1/ Why has microfinance always been so difficult?

2/ What has changed?

3/ With our Automated Repayment Mechanism (ARM), could micro and small businesses raise debt or equity capital like large companies do?

4/ Why is it necessary to set up an exchange platform?

5/ What is the role of the MAP?

6/ Has Micro Connect’s initial investment strategy achieved its strategic objectives?

7/ Could this new investment model be extended to markets beyond Mainland China?

8/ Where does this new investment model fit in today’s regulatory framework?

1) Why has microfinance always been so difficult?

The operating logic and processes of traditional capital markets do not work in the micro and small business universe.

At the core of traditional debt and equity financing arrangements are two pillars that instill trust and confidence among the investing public: (i) secure transaction delivery enforced by laws and financial regulations and underwritten by financial institutions such as banks, brokerages, exchanges, clearing houses, etc.; and (ii) transparent information disclosure supported by financial professionals such as accountants, lawyers, analysts, rating agencies, etc.

These two pillars provide the necessary confidence for investors to invest in long-dated financial products such as debt and equity with delivery of returns at a future point in time. Given the significant costs involved in providing these two functions, the system is designed to serve only large corporates and institutions.

Micro and small businesses, which may deliver strong financial returns, are not large enough and do not raise enough funding that can justify the significant costs involved under the traditional model.

2) What has changed?

Thanks to the rapid digitization of the Chinese economy, there are now alternative ways to perform the same functions provided by the two pillars, turning micro and small businesses into investable opportunities.

With the rise of e-commerce and ubiquity of digital payments, most small merchants in China now adopt payment aggregation services that ensure their daily revenue data are viewable and verifiable, and virtual banking accounts that allow daily revenue to be intercepted and split digitally. Together known as the Automated Repayment Mechanism (ARM), they effectively enable investors to capture data flows and settle cash flows from small merchants at very minimal cost.

ARM has been embedded in China’s financial infrastructure and most small merchants across the country, and it can serve the exact same roles typically performed by statutory market institutions and financial / accounting / legal professionals in traditional financial markets.

With the use of ARM, Micro Connect has pioneered DRCs, a new asset class that is tailor-made for micro and small businesses. DRCs focus on the recurring daily cash flows of micro and small businesses, who can now unlock the value of such cash flows by using daily revenue distribution as the underlying asset backing an investment product. ARM has become the key to addressing the funding issues faced by micro and small businesses.

3) With ARM, could micro and small businesses raise debt or equity capital like large companies do?

Yes and no. Yes, they can raise debt-like or equity-like financing but, unlike traditional debt and equity, DRCs are contractual arrangements structured around their daily cash flows.

In place of the two pillars in traditional finance, ARM can help micro and small businesses structure the financing contracts as either debt-like or equity-like products in a revenue-sharing arrangement. Businesses do so by identifying an optimal revenue-sharing ratio and contract period to properly reflect their underlying assets’ risk-return profile and investors’ risk appetite. For instance, a fast-selling trendy tea shop may be more suited for equity-minded investors, while a stable hotel business may be more attractive to debt-oriented investors.

While a DRC investor may legally rank junior to a credit investor, the DRC investor effectively enjoys superiority in being the first in line to recover returns from the store’s daily revenue stream. In other words, the DRC investor’s economic entitlements are based on a contractual collateralization of the business’s future revenue during the contract period. DRCs also give investors the ability to recoup their investments on a daily basis and reinvest such daily cash flows to enjoy compounded returns. This design has enabled micro and small businesses to provide stronger returns to investors while keeping their absolute financing cost low.

4) Why is it necessary to set up an exchange platform?

As DRCs have become the fit-for-purpose arrangement to connect global capital with micro and small businesses, and with the immense potential size of this market, there needs to be a central market infrastructure to organize and encourage the broadest participation possible by a diverse set of stakeholders.

This Micro Connect and MCEX infrastructure comprises the following key components:

- A cross-border infrastructure organized within MCEX and under the State Administration of Foreign Exchange’s (SAFE) existing forex control purview to facilitate capital flows into and out of Mainland China;

- An implementation system that expands the ARM network to cover as many micro and small businesses as possible, aggregate numerous DRC investment opportunities on MCEX, and collect returns from micro and small businesses on a daily basis;

- An origination network along with market guidelines that allows various types of intermediaries such as financial advisors, SaaS companies, and owners and operators of commercial real estate to originate, vet, and deliver DRC investment opportunities;

- A registration and custody platform that standardizes the key terms of DRCs and issues to offshore investors Daily Revenue Obligations (DROs), instruments that are listed and traded on MCEX and represent economic entitlements to their corresponding DRCs;

- An offshore payment, settlement, and clearing infrastructure that delivers daily cash flows collected onshore to the accounts of end investors offshore pursuant to their DRO contractual arrangements;

- A market infrastructure that allows qualified institutions to package DROs into various thematic baskets (regional, industry, ESG, etc.), also known as Daily Revenue Portfolios (DRPs), so that investors from Hong Kong, Singapore, and other major financial markets can more easily access diversified portfolios of DROs;

- A daily market data disclosure and analytics platform that allows investors and issuers to engage in pricing and valuation decisions, and rating agencies to provide rating services;

- A trading and clearing infrastructure that supports secondary trading and facilitates market making and liquidity provision.

5) What is the role of the MAP?

MCEX has designed the MAP to guide all market participants and calls for the market’s collective wisdom to further refine it.

When companies conduct equity and bond offerings, they would publish offering documents with financials prepared in accordance with the generally accepted accounting principles (GAAP). To attract institutional capital, micro and small businesses would need to follow a similar practice and provide disclosure that is accepted by investors. The market will need guidance on how to prepare full and proper disclosure on DRCs, DROs, and DRPs. For this reason, MCEX has decided to publish the MAP, a new market standard designed specifically for our daily revenue-sharing asset class, akin to GAAP in traditional financial markets.

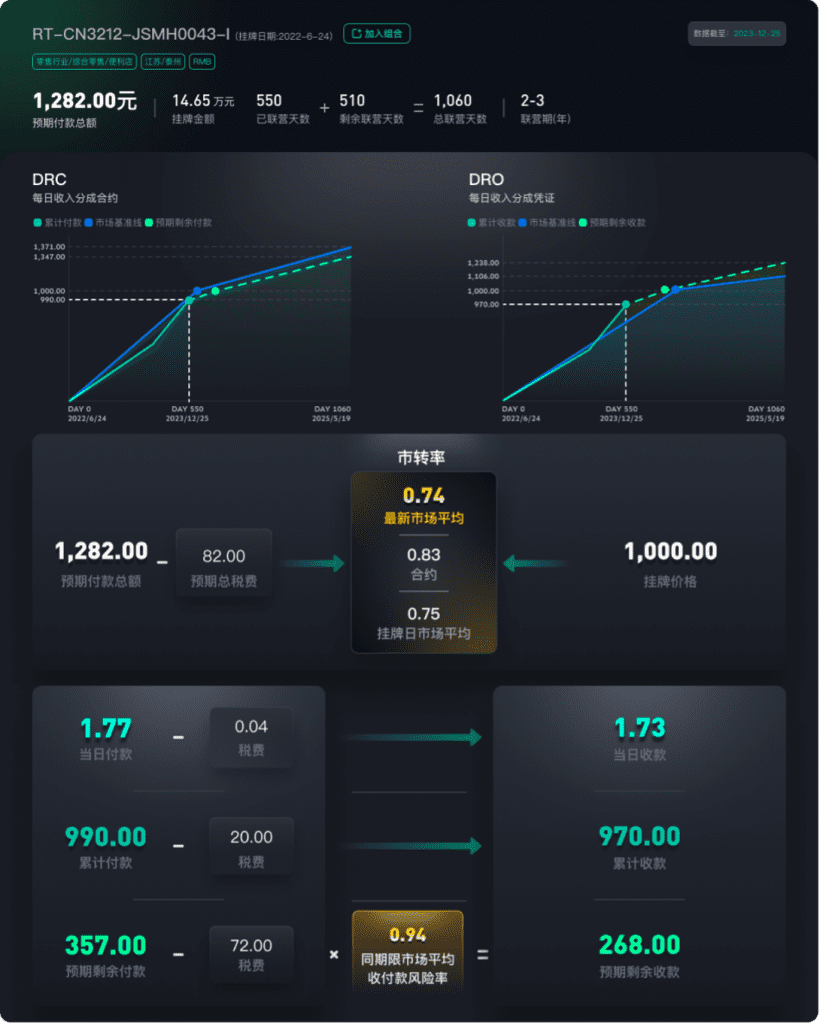

The MAP allows investors to easily access more granular and frequent data points. Each DRC / DRO corresponds to a MAP, which displays static information on the contract such as region, industry, listing date, expected total collection amount and contract period. The MAP is also refreshed and published on a daily basis, with data including (i) at the DRC level, how much cash is received on a particular day, the amount cumulatively collected to date, how much more is expected to be collected for the remaining contract period; (ii) at the DRO level, taxes, risk metrics, the post-tax risk-adjusted amount collected for the investor on a particular day, the amount cumulatively collected to date, and how much more is expected to be collected, etc..

The MAP also has a use case for owners and operators of micro and small businesses. It serves as a unified communication standard setting the way data are prepared and disclosed no matter where a business is located and what industry it is in. By simply filling in certain basic information on the MAP system, one can immediately find out for every RMB 1,000 that the business is looking to raise, how much revenue it will have to share on a daily basis, how long the sharing period should be, and how comparable businesses have performed.

MAP Display on a Single DRC / DRO

The MAP also serves as a basic toolbox for both investors and micro and small businesses to perform valuation exercises over any future cash flows, assisting them in pricing and negotiating financing contracts.

6) Has Micro Connect’s initial investment strategy achieved its strategic objectives?

Micro Connect has achieved all three of its strategic objectives, with slightly varying degrees of success.

In the past two years, Micro Connect, through its Micro Connect Leadership Fund, has invested in the DROs of more than 10,000 stores covering four major industries (food and beverage, retail, services, and culture & sports) and 270 cities in China. As of December 31, 2023, investors had deployed close to RMB 4.0 billion and received more than RMB 1.0 billion[1] in revenue shares from their DRC / DRO investments.

Micro Connect had three key objectives during the initial buildout of its pioneering portfolio: (i) validating the potential of this investment strategy by demonstrating real investment returns; (ii) detecting and developing insights on trends and revenue patterns along regional, industry, and other dimensions; and (iii) using such experience to inform on future decisions as MCEX develops the key components of the new market structure.

On the first objective, Micro Connect has successfully demonstrated the feasibility of this investment strategy and delivered reasonable but not exemplary returns. The less-than-impressive investment returns are the result of (i) inopportune timing of starting investing during the height of Covid; (ii) a strategy that is driven not only by return profiles, but also by maximizing coverages to both achieve risk diversification and gather as much insights and experience across industries, segments, and regions; and (iii) high initial friction costs driven by the steep learning curve both at Micro Connect and broader industry participants.

On achieving the second and third objectives, Micro Connect has secured large pools of high-frequency and highly relevant revenue and other operating data and developed a comprehensive suite of management software, valuation methodologies, allocation strategies, and due diligence standards, much of which are contained in today’s MAP publication.

As the number of external market participants continues to grow and in response to anticipated market concerns around Micro Connect’s dual roles as an investor (through its Micro Connect Leadership Fund) and a central market operator, Micro Connect will transform itself into a fully disinterested exchange operator, and MCLF will be funded by third-party capital and managed by independent third parties.

7) Could this new investment model be extended to markets beyond Mainland China?

The initial assumption was that this would only work in Mainland China, but Micro Connect has now found a new approach to taking this model to markets globally.

Until now, the success of DRCs has been predicated on what ARM can deliver – the ability to monitor revenue and capture cash flows daily and digitally from an invested store. As such, the initial strategy has been to “follow the chains”, i.e., identifying the most digitized brand / chain / franchiser partners and investing in stores under their networks. As of the end of 2023, the Micro Connect model had funded more than 10,000 stores belonging to over 688 brands / chains / franchisers, with another 3,000 in discussions. This approach still has huge potential as the chain rate of China’s 70 million micro and small businesses continues to rise from the current 20%, compared to the 70% level seen in developed markets such as the US.

Meanwhile, a new strategy seeking to invest in stores that are not part of an established brand / chain / franchiser has now been tested with initial success. This new strategy is to “find the root”, i.e., location partners such as owners and operators of commercial properties who are landlords of store premises. Location partners either have already established digital controls over their tenants’ revenue or can be easily incentivized to build such controls in order to secure DRC financing for their tenants’ rental payments or capex needs (e.g., renovations, space expansions, or equipment purchases). With their financial interests largely aligned with those of investors, location partners are the most effective and motivated originators, risk managers, and enforcers of contractual rights for investors of the relevant stores’ DRCs.

Partnerships between landlords and investors can also help reduce the barrier to entry for entrepreneurs with limited financial resources as landlords will be able to vet potential tenants purely based on the tenants’ motivation and operating ability rather than their financial resources.

With this new “finding the root” strategy, the DRC investment model can now be extended to less digitized markets where there is significant amount of cash transactions. The most effective mechanism to prevent cash leakage would be to work with landlords, who are the most incentivized to act as the frontline controllers of the tenants’ revenue level.

8) Where does this new investment model fit in today’s regulatory framework?

Micro Connect embraces regulation and hopes that onshore investors will eventually have access to our new market.

Micro Connect’s capital raising activities take place offshore and are regulated by Macao’s and Hong Kong’s financial regulators. Its asset origination activities take place onshore and are subject to oversight by local industry & commercial bureaus and tax authorities. Capital flows into and out of Mainland China are subject to foreign exchange control by the SAFE.

Micro Connect anticipates that its offshore regulators will pursue regulatory assistance programs with their onshore counterparts following similar regulatory arrangements successfully implemented under Stock Connect, Bond Connect, and Wealth Management Connect.

Although MCEX currently does not accept participation from onshore capital, Micro Connect believes that it is only a matter of time when onshore investors begin to consider entering this market. DRC investments will not only provide them with quality returns but also an opportunity to support the political and social objectives of helping micro and small businesses and promoting common prosperity. Meaningful participation by onshore capital will eventually herald the development of a clearer and more tangible onshore regulatory framework.

One of the key objectives of publishing the MAP is to demonstrate the unique and superior risk management mechanism that is embedded in the daily revenue-sharing investment model. This will hopefully provide future regulators with added comfort in evaluating and regulating such investment activities. More specifically, the Micro Connect model’s unique risk management functionality lies in the distributed nature of the underlying assets (down to units of a single contract of an individual store) and the daily frequency of revenue disclosure and cash collection, which give us features not seen in traditional finance: (i) daily incremental exit; (ii) daily incremental reduction in risk exposure; (iii) daily data disclosure and machine learning; and (iv) daily compounded reinvestment returns.

[1] Total amount collected from December 2021 to December 2023.